Describe Three Services That Banks Provide

The answer is A. The three services that banks provide include saving accounts accepting deposits and providing loan facilities.

Difference Between Neft Rtgs Imps Differencebetweenneft Imps Neft Rtgs Ampimps Trgs Bank Loan Balancetransfer Money Online Instant Loans Different

Compare Checking Accounts With Banks That Have Different Perks.

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

. Different banks might specialize in or emphasize particular types of loans. So they have to advance a loan to the public. What is the spread and why is it such an important concepts for banks.

Sometimes the bank provides overdraft facilities to its customers through which they are allowed to. Banks provide not only various domestic banking facilities but also international banking services. Some common types of loans that banks provide include.

The safest place to store your money. They insure guarantee underwrite participate in managing and carrying out issue of shares debentures etc. Credit unions which are nonprofit organizations often owned by their members offer similar services to banks including both deposit accounts and loans.

Nowadays an increasing number of financial institutions operate online which in some instances may reduce some of their services fees. Export and import credit foreign letters of credit cross country payments currency exchange remittance from abroad and such other services are provided to individuals as well as business entities. Commercial banking focuses on products and services that are specifically designed for businesses such as deposit accounts lines of credit merchant services payment processing commercial loans global trade services treasury services and other business-oriented offerings.

Services offered by commercial banks include accepting bank deposits giving business and mortgage loans and offering basic investment products like a savings account and certificates of deposit. Credit unions provide financial services for their members including savings and lending. Export and import credit foreign letters of credit cross country payments currency exchange remittance from abroad and such other services are provided to individuals as well as business entities.

Review The Options Now. Online mobile and tablet banking. A business that is a not-for-profit cooperative bank that is owned and controlled by it members.

Check with local financial institutions in your community for specific details about their products and services. Find out more about what commercial banking offers and how to. The major categories of financial institutions include.

Investment Banking and Wealth Management. You can go to a bank with a check and receive cash. Auto and boat loans.

LoansLoans are a common banking service offered and they come in all shapes and sizes. Other services commercial banks offer may include currency exchange business consulting investment advice wire transfers online bill payment tax return filing buying and selling securities insurance services and more. Alternative Investments such as mutual funds and other securities.

Describe three services that banks provide 2 See answers Advertisement Answer 1 Diaperboy Business Loans Checking Accounts Debit and Credit Crds No problem Advertisement Answer 0 anyelleal3p3saua Checking and Savings Accounts. 18 Types of Bank Services 1. Banks provide business-specific financial services that help business owners manage their money.

Additional services may include safe deposit boxes and investment-related services. Individual BankingBanks typically offer a variety of services to assist individuals in managing their finances including. The three services that banks provide include saving accountsaccepting deposits and providing loan facilities.

Checking accounts Savings accounts Debit credit cards Insurance as per their tie up with different insurance companies Wealth management. Banks will typically offer digital banking services that include. What determines which options a bank is likely to choose.

Financial services provided by bank are known as finance services to a broad range of businesses entities including insurance companies credit card companies credit unions companies personal finance stock brokerages investment accountancy. Most commercial banks have physical locations with employees and many also have ATMs available in locations throughout the country. Give an example of each.

Ad Compare Banks With Online Checking Accounts. Explain the major options available to a bank that is short of reserves. With lower operating expenses those savings can often be passed along to customers in the form of lower monthly fees or higher interest rates on savings accounts.

You just studied 35 terms. Up to 25 cash back 6. The answer is A.

Those include personal loans loans through credit card accounts mortgages on real estate and auto loans. After keeping certain cash reserves banks provide short-term medium-term and long-term loans to needy borrowers. While most banks today offer online services there are also banks that exist solely online.

See This Years Standout Checking Picks. Advancing Of Loans Banks are profit oriented business organizations. Discounting Of Bill Of Exchange.

The banks can also act as an agent of the Government or local authority. A non profit financial institution that is owned and operated entirely by its members. Banks have diversified their service and have so much more to offer.

So they have to advance loan to public and generate interest from them as profit. A bank that offers a broad range of deposit accounts including checking savings and certificates of deposit and which extends loans to individuals and businesses. In addition to basic checking account services that allow business owners to deposit funds and.

Describe the major assets and liabilities on a banks balance sheet. Now up your study game with Learn mode. Banks are profit-oriented business organizations.

Banks provide access to cash. The services most often provided include a variety of checking accounts saving accounts certificates of deposit and loans including car loans and home mortgages. Regarding the other options B - All banks may not provide insurance services C - Pay checks are given by employer to his employee for the services rendered D - Money is printed by the central bank of the country not.

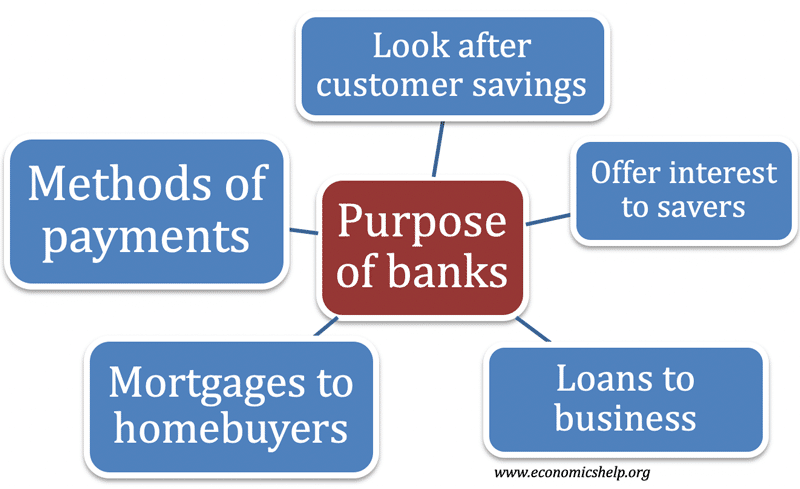

Purpose Of Banks Economics Help

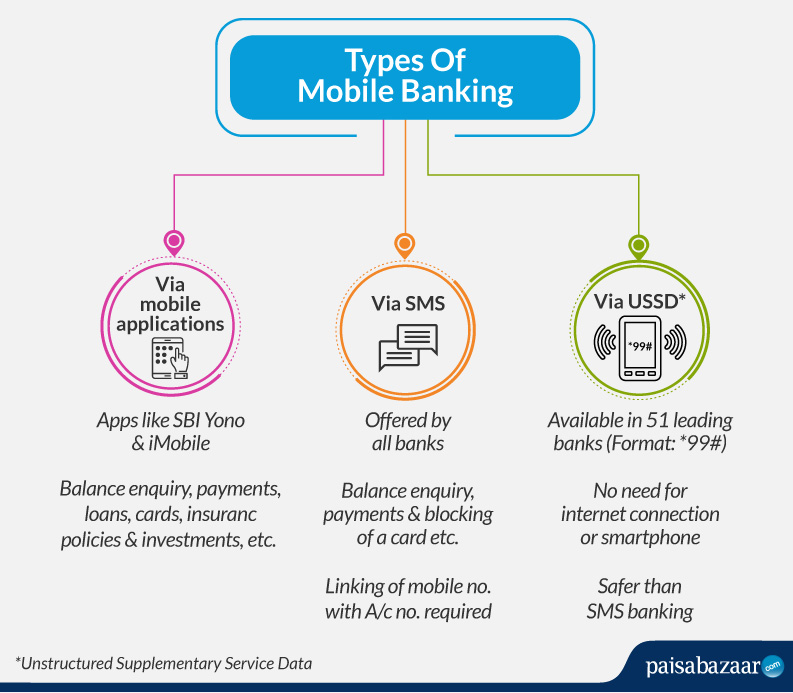

Mobile Banking Types Of Mobile Banking Services Paisabazaar Com

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

Europe S Financial Reforms What Are The Next Big Changes Knowledge Wharton Capital Market Europe Banking